Phoenix Energy is an energy company developing pioneering solutions for hydrogen production using innovative membrane technologies. While still in the concept phase, the company gained the trust of Sabancı Holding, secured seed funding through the ARF investment project, and took a strong first step in its growth journey. With its patented Phoenix Membranes, hydrogen can be separated from all gases with 99% purity. This breakthrough contributes to reducing carbon emissions, increasing energy efficiency, and supporting sustainable production goals. Phoenix aims to be an integral part of the global energy transition.

Yusuf Furkan ERGÜR

Founder, Phoenix Energy

To transform waste from industrial processes into high value-added energy, while reducing the carbon footprint and creating cost advantages for businesses.

To turn an innovation born in Turkiye into a strong, sustainable, and lasting player on the global energy stage.

Phoenix Energy is committed to accelerating transformation in the energy sector in line with the United Nations Sustainable Development Goals.

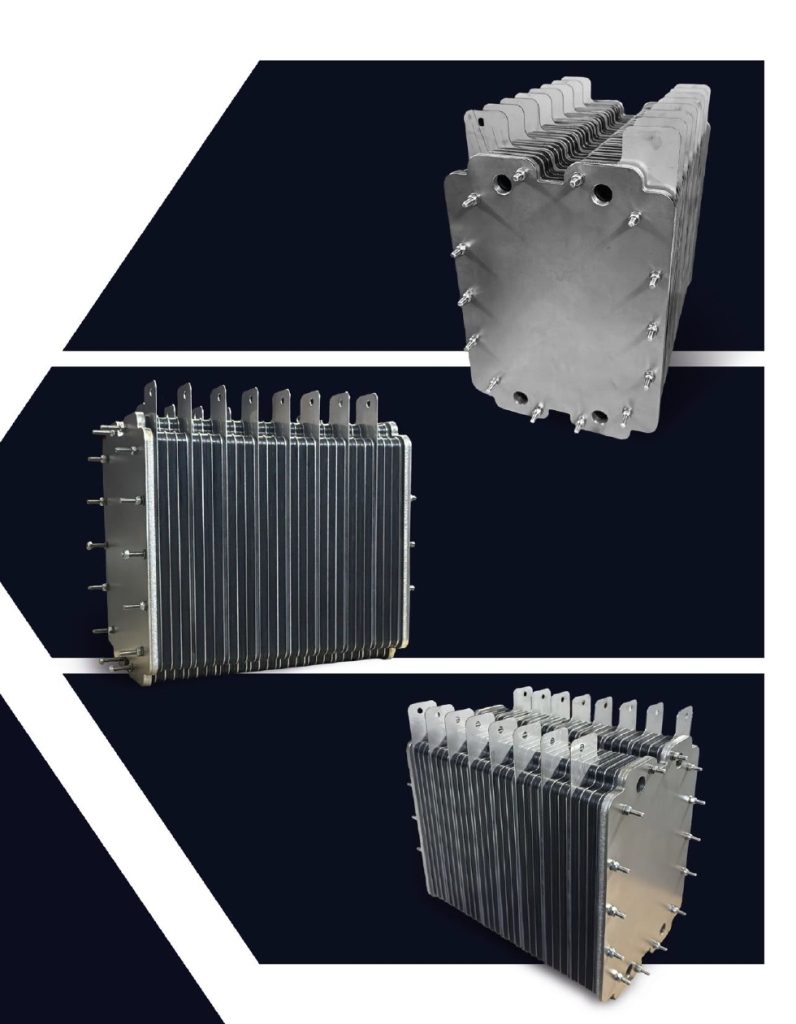

Phoenix’s next-generation electrolyzer introduces a groundbreaking architecture built around 32 anode-cathode pairs, of which only 8 are electrically powered. The remaining 24 pairs are engineered from advanced Peltier thermoelectric materials, enabling the system to capture the heat naturally generated during electrolysis and convert it back into usoble

electrical energy. This integrated thermoelectric recovery system allows the electrolyzer to deliver up to four times the effective electrolysis power relative to the external energy supplied. As a result, hydrogen production becomes dramatically more energy efficient and cost-competitive-reducing the cost of green hydrogen to the level of conventional grey hydrogen and marking a transformative leap in sustainable energy technology.

Our product represents a new class of electrolyzer that merges classical electrochemistry with thermoelectric energy harvesting The system’s 32-electrode configuration-8 active and 24 Peltier-based creates a self-recovering power cycle in which internal heat losses are continually converted into additional electrical input. This unique mechanism significantly reduces operating costs, increases overall efficiency, and unlocks a pathway to affordable, scalable green hydrogen production. Through this innovation, Phoenix establishes a new benchmark: a high-performance hydrogen unit capable of competing directly with fossil-derived hydrogen in price and efficiency.

Phoenix’s collaboration strategy is focused on partnering with industrial operators, research institutions, and global energy developers to accelerate commercialization. We aim to co-develop pilot deployments, expand into large-scale production environments, and secure international certifications for green hydrogen systems. Collaboration with universities will further strengthen our research capabilities, while strategic partnerships with manufacturers and investors will support global rollout and industrial scalability. Our long-term vision is to build a robust ecosystem that delivers accessible, efficient, and

economically viable green hydrogen worldwide.

Conventional electrolysis systems, the heat generated during operation must be actively removed to ensure system stability. This cooling requirement increases energy consumption, raises operating expenses, and adds complexity to the overall system—directly impacting project economics.

Phoenix Enerji’s electrolyzer eliminates this inefficiency.

Instead of wasting heat, the system converts it into electricity through proprietary thermoelectric generator (TEG) modules designed specifically for high-efficiency power recovery. The recovered electricity is fed back into the electrolyzer, reducing net external energy demand well beyond conventional efficiency expectations.

This architecture enables the Phoenix electrolyzer to deliver a substantially higher effective electrolysis output per unit of external power input. For investors, this translates into lower electricity costs, improved margins, and faster payback periods compared to traditional electrolyzer technologies.

By generating power directly from waste heat, Phoenix electrolyzers operate with significantly reduced net energy consumption. Moreover, when integrated with existing industrial waste-heat sources—such as chimneys or hot process streams—the system can be configured to operate with zero external energy input, creating a highly disruptive cost structure in the hydrogen market.

Our founder, Yusuf Furkan Ergür, first applied the Phoenix Membrane developed while he was still a high school student to motorcycles. This innovative approach reduced fuel consumption and marked the beginning of Phoenixʼs journey in energy efficiency.

At the next stage, the Phoenix Membrane was applied in biogas plants to filter H₂S gas and obtain hydrogen. This method enabled the conversion of waste gases into energy, strengthening Phoenixʼs sustainability vision.

Following its exit, Phoenix redirected its R&D efforts toward Peltier technology, developing innovative electricity generation solutions.

Phoenix integrated Peltier technology with electrolysis, producing the metal alloys of HHO generators using Peltier. This resulted in a new generation of electrolyzers that generate 75% of their energy from the heat they produce. This innovation was introduced internationally and recognized with an award by the President of TÜBİTAK.

These products have been developed for industrial-scale use, with promotional activities continuing at pace.

The performance of Phoenix Energyʼs HHO tech. has been tested and certified by TUV Austria, an independent international inspection body. This certificate officially confirms the claimed high efficiency values.

Analyses conducted by the Turkish Energy, Nuclear and Mineral Research Agency (TENMAK) certified that hydrogen produced with Phoenix Membranes reached 97.25% purity. This result demonstrates Phoenixʼs technological superiority and compliance with international standards.

Phoenix is an R&D, engineering and consulting firm working on reducing carbon emissions and energy costs in industries with chimneys.